While investors from all sectors are focussing on investing in sustainable products, the complexity of evaluating sustainability factors has increased. The collection of ESG-relevant information in the transaction process plays a key role. No market standard has yet been recorded for the information economy. This must be established with regard to the ongoing management of the property.

Future-oriented and sustainable action is written into the specifications of both investors and operators of real estate. Sustainable use of the real estate itself should be anchored in the rental and lease agreements. Rigid definitions and fixed assessments become dynamic processes with functional demands on the flexibility of the design. The legal scholars are pleased, as they are increasingly being commissioned and actively involved with technical aspects of lease drafting. It is hard to imagine due diligence processes without the recording and evaluation of sustainability factors, both technical and non-technical. From the developments of past years in the preparation of information with sustainability character, the group of participants is expanded: Financing institutions define the hurdles of external funding.

The discussion about sustainable investments is controversial on all sides of the table, as the Disclosure Regulation and taxonomy cast their shadows far ahead. National regulations such as the EnEV (Energy Saving Ordinance) and the GEG (Building Energy Act) for Germany should not be ignored. The definition of minimum standards plays just as important a role as the adaptation obligations of existing buildings when the substance is interfered with. Answers to clarify the funding question are rarely clearly defined. Thus, the targeted preparation of information is required in order to build up suitable chains of argumentation.

A discussion of the requirements for managing money flows into sustainable investments is firmly established at both the EBA (European Banking Authority) and BaFin (German Federal Financial Supervisory Authority). Corresponding regulations have also been incorporated into the MaRisk working papers (Minimum Requirements for Risk Management). The number of providers of ESG or ESG-related services, whether consulting or operationally involved in implementation, has increased significantly. In principle, this dynamic is to be welcomed, but it often does not meet with the necessary opposition. This change will also be experienced by future generations, because “ESG has come to stay”.

We have to deal with the sometimes profound changes and incorporate collective as well as responsible action into the consciousness. Attempting to answer the question of who is to blame for climate change is not very effective in terms of thematic reappraisal. One thing is certain, however: it will be uncomfortable. Temperature records and weather changes show demonstrable evidence of climatic changes. The interaction of our real estate with its environment must therefore be given a decisive role. Thus, they form the living space for generations and, in addition to production and industry, house social facilities and public institutions such as schools and administration. Last but not least, we get no guarantee or promise of success in stopping global climatic changes.

Looking to the future, the property valuations and real estate transactions of today lay the foundations for sustainable action tomorrow. Hardly any of the players can escape this change – the opposite is true: Over 90 per cent of institutional investors have ESG due diligence carried out. It is not always an integral component of technical due diligence and, due to the diversity of information, only one component in the collection of information in the data room. At the top of the investors’ wish list are EU taxonomy-compliant products. An identification of such features in the real estate transaction requires the recurring examination of the rules and regulations by the evaluating and consulting companies. The scope for prosaic formulations of past months is becoming increasingly smaller, so that the degree to which the assessment is binding is rising. Thus, an independent declaration of conformity on the completeness of the fulfilled test requirements according to EU taxonomy represents an essential quality criterion.

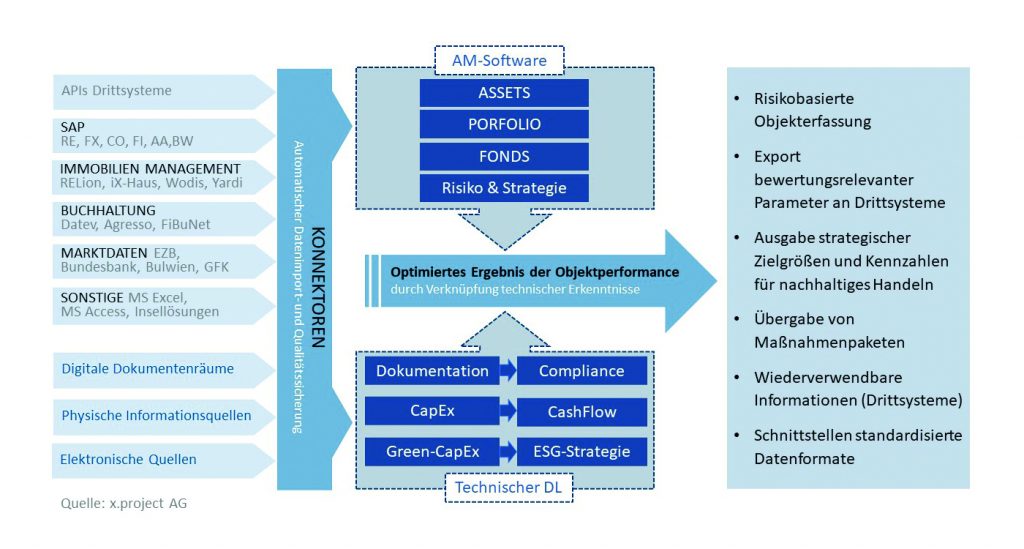

A not insignificant problem in the recording of ESG-relevant factors can be found in the unstructured information available. Structured digital document spaces are rarely available. Even more rarely, the information is available in electronic data formats from existing systems. From the investor’s point of view, this also represents a time hurdle in the identification of potentially value-driving influencing factors. Findings published at almost weekly intervals about increased returns on sustainably oriented real estate come as little surprise if the market is offered a product whose demand is rewarded accordingly via the purchase price and rents. If one tries to determine the “sustainability of a real estate transaction”, essential characteristics of the information economy can be identified:

- The information is available once(ig). Repeated saving of files with the same content under different names should be avoided and ensures the necessary information hygiene.

- Captured information is coherent, i.e. it is in context with the object and can be transferred to processes in the company.

- Available information is quality-assured, i.e. it is provided with a source whose verifiability can be verified through meaningful linkage.

- When exchanging digital information, standardized formats are used, which are based on the gif formats, for example.

The time pressure during the due diligence phase can be reduced by specifically requesting the required information. This is especially true for information that exists but was collected in a different context. In this way, exemplary documents can be assigned to the relevant assessment fields in order to place their contents in the context of sustainability. The use of cloud-based data room solutions in real estate management support this process.

- Evidence from the leakage testing of base pipes can be used in water conservation and compliance assessments. Similarly, the perception of the company’s social responsibility can be recorded.

- Qualified outdoor facility plans are integrated into the context of area sealing quotas at a technical level and the identification of recreational areas for employees. In addition, the information source is suitable for assessing site-specific biodiversity.

- Recording realised repair measures on structural and technical components not only supports the evaluation of financial key figures and the assessment of non-allocable/allocable cost risks, but also opens up the possibility of calculating service life-based valuations in order to derive useful lives;

The assessments focus on greenhouse gas-relevant (GWP – global warming potential) and thus climate-changing substances. In practical terms, CO2 emissions are related to stranded-asset analysis in the case of real estate. The execution of a “stranded asset check” with the reference value CO2 emissions on the basis of the CRREM-SBTi path, including the update of 12.01.2023, is now part of the standard program of every ESG assessment. It should be noted here that the valuation characteristic “stranded asset” is all too often understood in an incomplete context. A property that has a low emission value and does not represent a stranded property according to the criteria of the decarbonization path, but is not suitable for further use either structurally or due to its location, must be managed as a stranded asset because access to the capital market is limited or no longer available. In terms of sustainable real estate transactions, it is therefore of considerable importance to map qualitative criteria of the investor (e.g. managed to ESG) and to integrate them into the decision-making process. Only by having a comprehensive picture of the valuation fields under ESG aspects, a real estate transaction can be structured in a sustainable way. The creation of an ESG dashboard is recommended for the early identification of these risks. In this way, the key valuation characteristics can be brought together from different sources and incorporated into the respective property strategy.

An ESG-based transaction model is usefully complemented by the definitions of the target system. This can be described in the broadest sense and thus generally as “the platform used by the purchaser to operate and manage the object of purchase”. The updating or adaptation of the assessment fields by the buyer is then consistently supported if the documentation of the sustainability assessment is linked to the property. In this area, IT developers and PropTechs face a mammoth task. Heterogeneity has dominated market activity to date.

CONCLUSION

Sustainability criteria can be found in almost all areas of the real estate industry. These factors and valuation parameters of different origins must now be understood as an integral building block across all levels of real estate management. Incorporating quality-assured information is critical to a structured and sustainable information economy. The targeted use of platform- and cloud-based IT solutions with flexible connectors between source and target systems reduces valuation risk and supports participants in the transaction process in early risk detection. The reuse of ESG-relevant data by the participants involved in the process makes the transaction itself sustainable.

Henry Fritzsche

Chief Operations Officer

Published in the ESG PRAXIS kompakt of FondsNews. Issue 2023.